Capital-Protected Yield Farming

Single-click pseudo market-neutral strategy with a human touch

WHY?

We are all humans after all

You can’t predict P&L

You can work out square roots and run simulations in your head? Taking into account impermanent loss and borrowing interest too?

You can’t predict P&L

You can work out square roots and run simulations in your head? Taking into account impermanent loss and borrowing interest too?

You don’t know past performance

We all define our ‘past’ differently. In most DEX it’s 24h/7d trading fee only. And we want more. How about a full breakdown including price impact?

You don’t know past performance

We all define our ‘past’ differently. In most DEX it’s 24h/7d trading fee only. And we want more. How about a full breakdown including price impact?

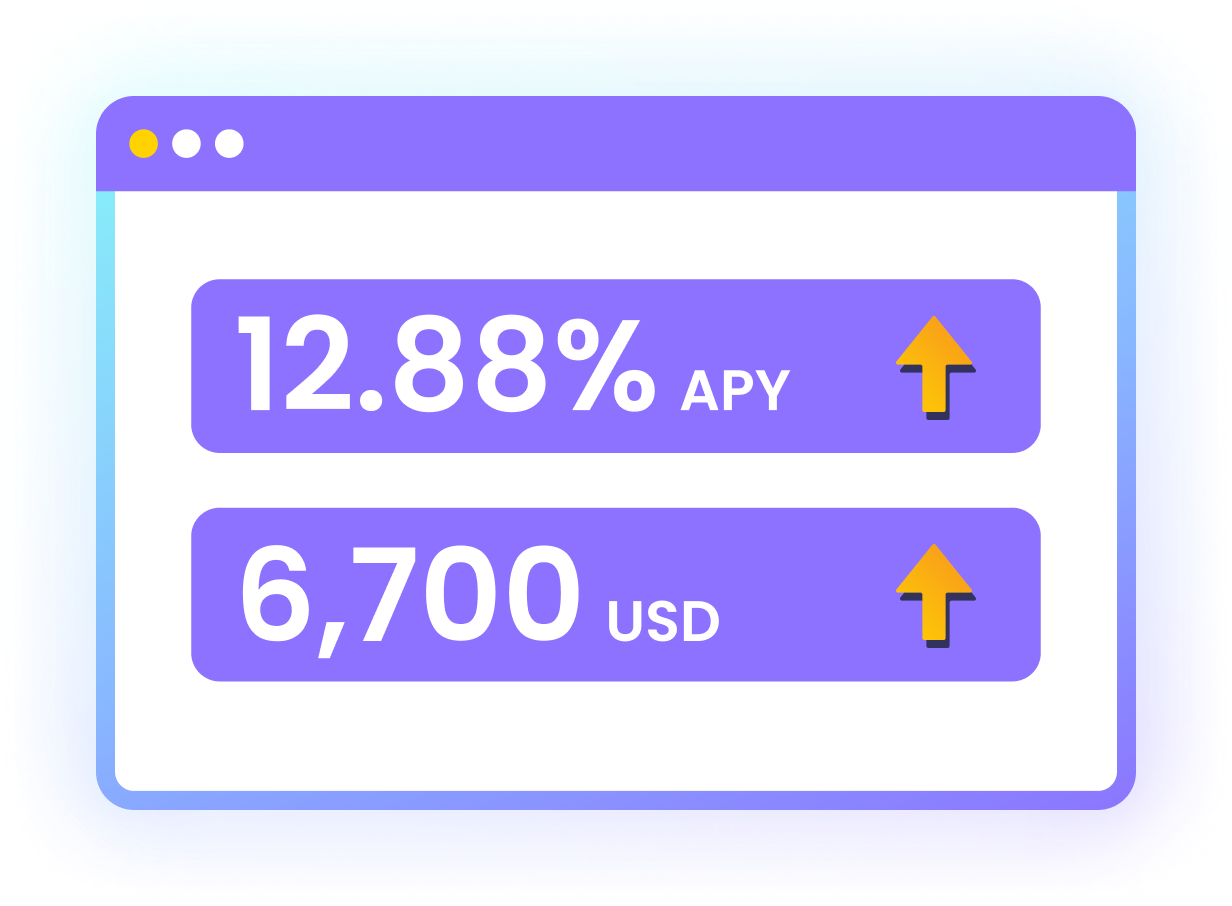

You don't know the real APY

The APY is never your APY. It is not calculated from the day you make your investment. How much are you actually earning?

You don't know the real APY

The APY is never your APY. It is not calculated from the day you make your investment. How much are you actually earning?

Single-click pseudo market-neutral strategy

Single Finance is a super intuitive platform to all your DeFi investments minimizing correlations to the general market. Everything here is worked out from your injected capital in USD. Everything is visualized. And everything is within your fingertips.

Maximize return

Minimize impermanent loss

Manage maximum downside

We do all the work for you:

- Increase leverage to maximize return

- Auto capital protection bot to protect capital in USD

- Borrow non-stable asset to minimize impermanent loss

- Rebalancing the portfolio to delta-zero from time to time

Case Study

Assume you invest 10,000 BUSD in BTCB/BUSD LP in PancakesSwap

High APY

is misleading

Existing APY calculation mechanism ignores the value change due to price impact of assets in the liquidity pool.

Even if you get 10,000% APY, the value ending up in your wallet could still be less than your principal in USD.

- We tell no lies

We keep your books in USD

We give you a comparison of past performance vs current APY of your farming pool. We track your principal and P&L in US dollars. You know how many pizzas you have earned.

- Backed by bots

We have your capital protected

Forget about liquidation and debt ratio. Use our Capital Protection Ratio to execute stop-loss automatically. Get back at least 85% of your capital in USD regardless of bear or bull markets.

- Market neutral most of the time

We rebalance your position to Delta-zero

A single-click rebalance button in case of sudden changes in market situation. The borrowing position will be rebalanced to match the amount of non-stable coins in the liquidity pool.

The first liquidity pool database

LP Time Machine

Performance analytics of liquidity pools across chains

Historical performance tracker

You define the length of history to view and backward-simulate the P & L based on capital marked to USD.

Full breakdown of annualized P&L

Show you the full breakdown of annualized P & L, including LP rewards, DEX reward tokens, and value change due to the price impact

LP earning metrics

APY. Fees. Rewards. These are all important. But what about risks and volatility? We have better metrics that help you pick the best pairs.

DeFi strategy analytics

Staking. Yield farming. Leveraged. Deleveraged. See the corresponding risks and returns yourself and craft your own winning strategy.

Roadmap

[Style][Don't delete]Start

- Submit smart contract codes to Certik for security audit

- Deploy MVP on Cronos and Avalanche Fuji testnet

- Complete user interface for Single-Click Strategy

- Develop cross-chain support for token contracts and core minting logic

- Build our own index nodes and develop the core logic of LP Time Machine

- SINGLE token launch

- IGO on VVS.finance

- CEX-MEXC, Gate.Io listing

- Complete audit with Certik

- Launch LP Time Machine with chain data of Binance Smart Chain, Fantom, Cronos and Avalanche

- Launch single-asset lending and staking vaults for CRO, VVS, SINGLE, and USDC

- Launch a Pseudo Market-Neutral Strategy for CRO/USDC, VVS/USDC, and SINGLE/USDC

- Integrate with MMF to support leveraged yield farming

- Launch a Pseudo Market-Neutral Strategy on Fantom

- Integrate with MMF to support Pseudo Market-Neutral Strategy

- Support cross-chain bridge (Multichain/XY Finance)

- Launch manual re-balancing feature for Single-Click Strategy

- Coin-based UI for yield farming

- Updated portfolio bar to track lending APR in terms of token number

- VeSINGLE Locking Vault

- Stablecoin pair swap through Stableswap to minimize price impact

- Capital Protected Amount swap through Stableswap to minimize price impact

- Single-Click Leveraged Short/Long Strategy on Cronos and Fantom

- Integrate with third-party dashboard (Zapper) on VVS farming

- Integrate with third-party DeFi Aggregator (DefiLlama)

- Partner with more protocols to expand our ecosystem

- Support swap in best path on multiple exchanges

- Support “Stop-loss, Lend and Stake”

- Support manual harvest of multi-yield

- Launch dashboard for portfolio analysis

- Dark Mode

- Integrate insurance coverage

- Introduce more market-neutral strategies

- Support DEX boosting features on Strategy & Leveraged Yield Farming

- Provide exclusive access to boosted farms for veSINGLE holders

- Launch Community Program

- Integrate with Defillama to list on the “Yield” dashboard

- Implement Governance

- Add hot LP pairs

- Partner with Wallet to expand our ecosystem

- Unlock exclusive farming opportunities for veSINGLE holders

- Implement compounding feasibility on veSINGLE & bonus SINGLE in the Boost Vault

- Chain expansion

- Integrate with additional DEXs

- Integrate with Camelot xGRAIL boost farm & nitro pool

- UI Revamp & Upgrade

- Partnership with multiple lending & borrowing protocol on Arbitrum to create arbitrage strategy

- Substitute the Multichain’s contract and resume the bridging function

- UI Revamp & Upgrade

- Complete extra set of smart contract audits

- Integrate with lending & borrowing protocol to grow the vault assets

- Confirming 1 more chain expansion with foundation’s support

- Integrate with additional DEXs

- Research & develop the cross-chain function: Farming

- Product revamp (Arbitrum)